You still have time if you’re considering purchasing or leasing an EV. You must sign a purchase agreement and make a payment by September 30, but you do not need to have delivery by that deadline.

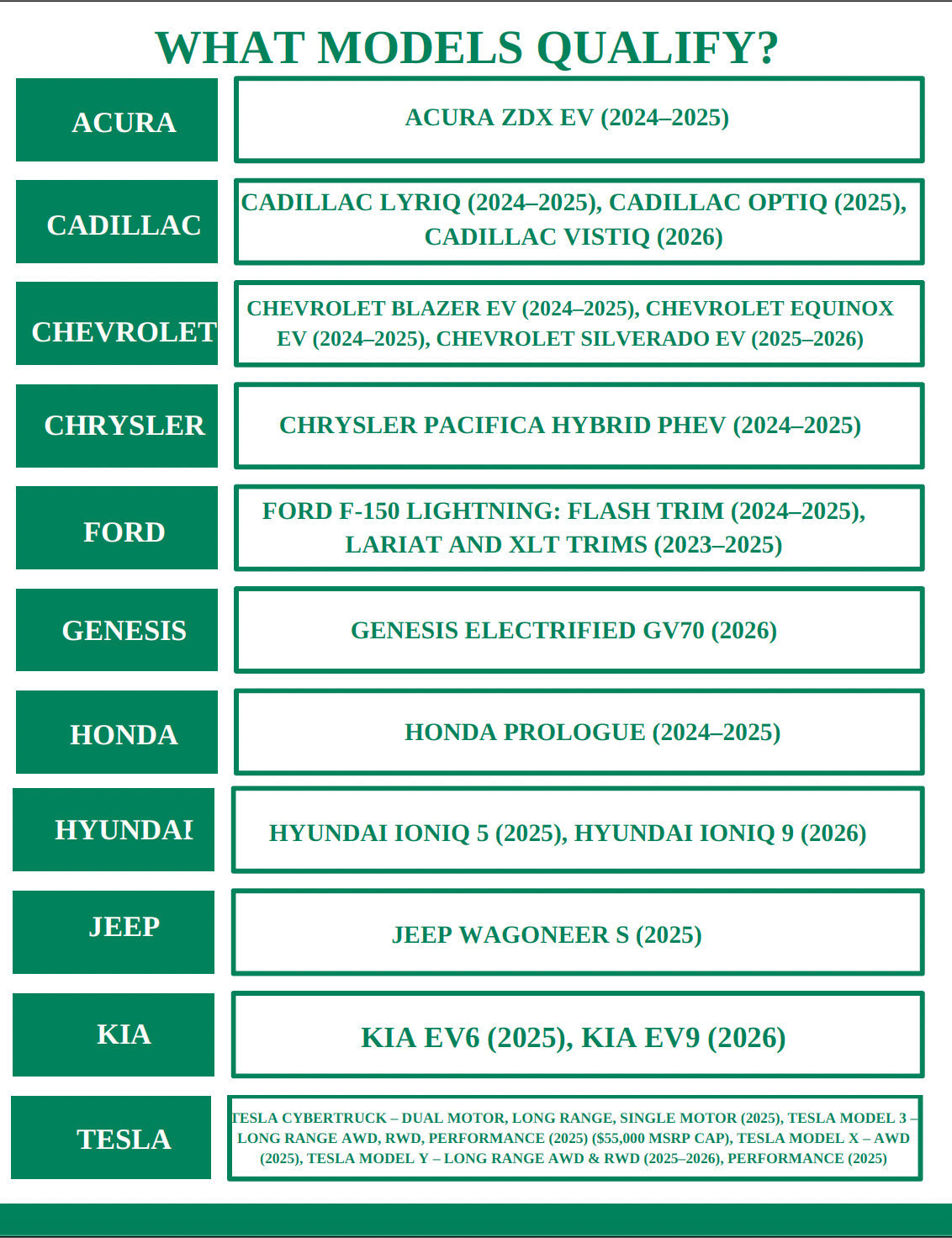

As detailed in Green Energy Consumers Alliance’s latest blog post, “Get Your Electric Car By September 30,” the federal tax credit for new and used electric vehicles will end on September 30, 2025. This means that after this date, the opportunity to claim up to $7,500 in federal savings on eligible EV purchases will no longer be available.

Need help finding the right EV? Check out GECA’s free EV Finder.

This credit has been a significant incentive, making EVs more accessible and affordable for many. Losing it means a substantial increase in the effective cost of a new or used electric vehicle.

What you need to know:

- Deadline: To qualify for the federal tax credit, you must purchase or lease an eligible electric vehicle on or before September 30, 2025.

- Act Now: We strongly encourage you to finalize your EV purchase or lease plans immediately if you wish to take advantage of this expiring incentive.

- Learn More: For full details on how the credit works, eligibility requirements, and why this deadline matters even if you lease, please read GECA’s blog post.

Even without the federal tax credit, electric vehicles offer incredible benefits—from lower fuel and maintenance costs to a smoother, quieter driving experience and reduced emissions.

Recently on Twitter