About 100 people attended a recent BU forum to learn that institutions and private investors will see no financial penalty if they remove fossil fuel companies from their investment portfolios.

Two financial management experts compared broad stock indices with and without fossil fuel stocks in companies involved in oil and gas extraction, oilfield services, refining and distribution.

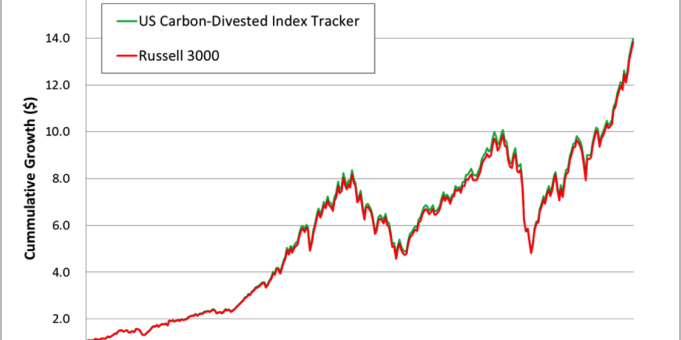

Lisa Goldberg explained that the performance of the Russell 3000 index from 1988 to 2013 was essentially the same with and without fossil fuel stocks. She is a professor at UC Berkeley and a principal at the Aperio Group, public investment specialists.

Goldberg also discouraged shareholders from hoping to influence fossil fuel companies to change their core business. She described how Chevron agreed to curtail some of their impacts and later reneged on its commitments.

Leslie Samuelrich, president of Green Century Funds, showed that the performance of the divested index was essentially no lower and in some years better than the actual S&P 500.

Bob Massie, co-founder of the Global Reporting Initiative, supporteddivestment as necessary, legal, and effective. His book, Loosing the Bonds, is about the successful 1980s divestment movement that targeted companies that did business with the apartheid regime in South Africa.

A second argument for divestment is based on the fact that fossil fuel companies have in-ground reserves that are at least five times more than can ever be burned without extreme climate change. Extracting and burning these reserves would force the world’s temperature to catastrophic levels.

Therefore, institutional investment portfolios will benefit from divestingfrom fossil fuel companies before the market recognizes these “stranded assets” and the value of the companies sharply decline.

As the divestment movement builds, an increasing number of forward looking institutional asset managers will offer divested portfolios. And, the divestment movement may even influence Congress to stop subsidizing petroleum extraction.

Important information about the Aperio Group’s analysis and chart:

Aperio Group has given Green Decade Newton permission to use the chart for this article. The chart may not be reproduced or used elsewhere without their permission. The following disclaimer applies:

The results presented in this chart are based on hypothetical analysis techniques (also known as back testing) and are not actual portfolios. Since returns included herein are hypothetical and based on back testing it is important to note that they are for illustrative purposes only. Past performance whether illustrative or actual is not a guarantee of future performance.

The chart was compiled from sources Aperio Group believes to be reliable, but we cannot guarantee accuracy. With respect to the description of any investment strategies, simulations, or investment recommendations, Aperio Group cannot provide any assurances that they will perform as expected and as described in our materials.

The Russell 3000 Index measures the performance of the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. The Russell 3000 Index is constructed to provide a comprehensive, unbiased, and stable barometer of the broad market and is completely reconstituted annually to ensure new and growing equities are reflected.

Recently on Twitter